public bank housing loan

OR Monthly loan interestfinancing profit rental whichever higher Resume 100 existing instalment 2. 50 of existing instalment.

Home Loan Home Loans Loan Build Your Dream Home

The program is on an annual first come first served basis and homebuyers must meet the following criteria.

. Bahasa Malaysia English Please select. Housing Loan Upto Rs30 lac. Conservative management style management tends to micro manage.

2 people found this review helpful. Authorizes the lending of public credit to public banks and authorizes public ownership of stock in public banks for the purpose of achieving cost savings strengthening local economies supporting community economic development and addressing infrastructure and housing needs for localities. Public Bank 5 Home Plan A term housing loan with no processing and monthly fees.

To apply for this product online you need to. Select Other Account or Favourite Other Account. Enter Amount MYR and click on Add to List.

Be 18 years old and above. With reamortizationextension of loan tenure. Repayment tenor up to 25 years.

Enter credit card number in Billing Account No. Get estimate from our home loan calculator to help you to calculate possible monthly repayments. Home Ownership Scheme Green Form Subsidised Home Ownership Pilot Scheme.

Benefit Great savings as interest rates are calculated on daily rest. Up to 75 Lakh. Another one in the list that offers a flexible home loan package is Maybank.

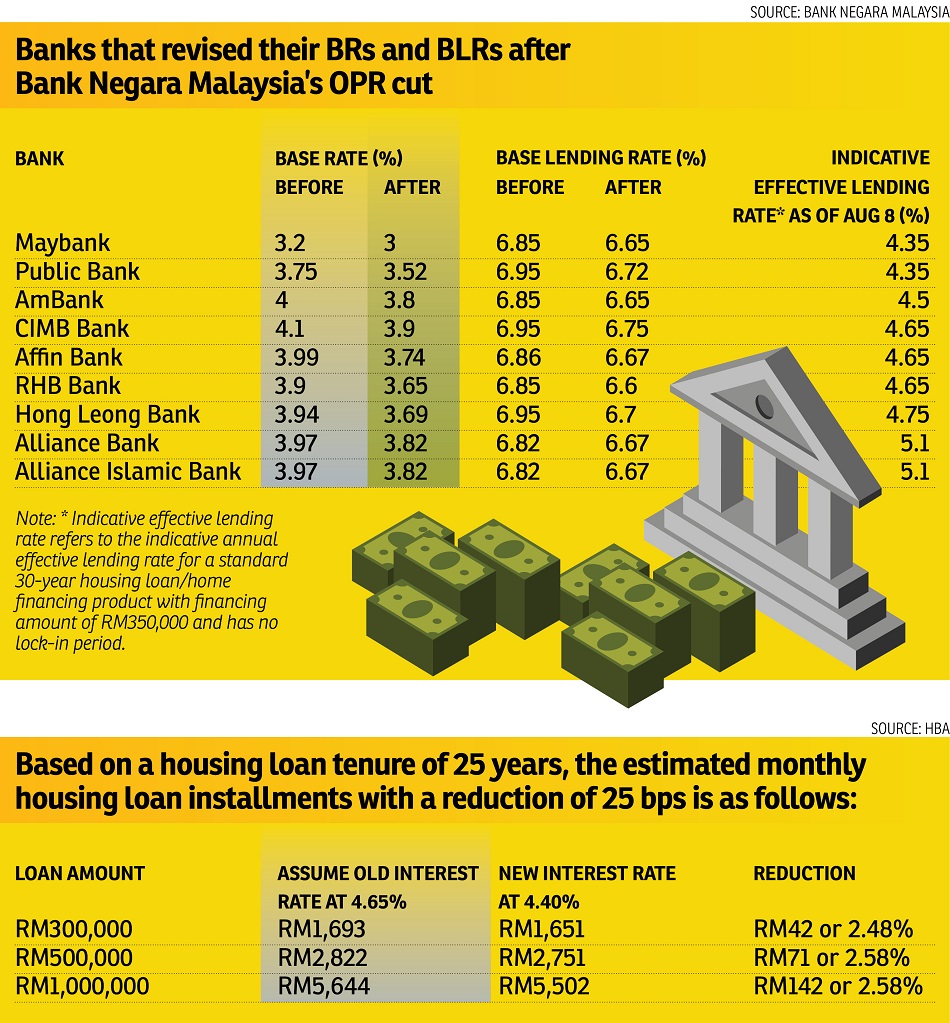

Relates to establishing the New York public banking act. Select your From Account. Indicative Effective Lending Rate refers to the indicative annual effective lending rate for a standard 30-year housing loan home financing product with financing amount of RM350k and has no lock-in period.

Customers are advised to visit our nearest. Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. Public Bank 5 HOME Plan gives you the flexibility of choosing from a wide range of different home financing packages depending on your financial needs.

Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. Be a first time homebuyer. This calculator is intended as a guide only.

Stay home stay safe and bank safe. Youve got questions Weve got answers. Through our partnership with the Federal Home Loan Bank of New York FHLBNY the HDP offers grants up to 10000 towards down payment and closing cost assistance to eligible first-time homebuyers purchasing a home.

Petaling Jaya Main Branch 50-52 Jalan Sultan 524 46200 Petaling Jaya 46730 Petaling Jaya Selangor Malaysia. Loan Amount RM. Select PB Card Payment.

However before you can borrow money from a bank you need to understand what types of loans are available and how to get approved public bank housing malaysia. Housing Loan Financing and Personal Loan Financing More details on AKPK URUS. Effective Lending Rate The indicative Effective Lending Rate for Public Bank is 310 with effective from 10 July 2020.

Home Loan Interest Rates of Top Public Sector Banks. NA Monthly Repayment NA. This home loan refinancing plan comes with fixed and variable interest rates with a semi-flexible repayment.

Competitive financing rates and. Public Islamic Bank gives no warranty as to the entirety accuracy or security of the linked web site or any of its content. Up to 30 Lakh.

Public bank housing loan interest rate 2019 In todays economy bank loans are often a small business owners best option for obtaining the funding they need to start or grow their business. Term Loans with Optional Overdraft Semi-Flexi and Full-Flexi Packages. Loan type Semi-Flexi loan Interest Type FixedFloating interest rate Lock In Period 3 years.

The Public Bank housing loan products offered by Public Bank include the 5 Home Plan which gives you the option to choose from a fixed Flexi and graduate loan repayment and the MORE. Loan amount up to 100 of purchase price 1. Apply for Public Bank 5 Home Plan by Public Bank Best Housing Loans in Malaysia 2022 - Compare Apply Online Apply for Public Bank 5 Home Plan by Public Bank This package allows you for room to plan and manage your finances with the benefits of an overdraft facility.

Public bank housing loan refinancing In todays economy bank loans are often a small business owners best option for obtaining the funding they need to start or grow their business. Housing Loan Above Rs75 lac. The 5 Home Plan gives borrowers the flexibility of choosing fixed or floating rate pricing.

Home Equity Financing-i provides the means to purchase a home or even to refinance with tenures up to 35 years. Dont worry Public Bank home loan lets you refinance or restructure your existing home loan and offers best refinance interest rate. Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.

Above 30 Lakh. Select your instruction mode and click. Apply I want to borrow RM For Year s Interest Rate.

Good bonus and benefits Extensive medical coverage very good staff housing loan rate etc Cons. Pay 25 of existing monthly loanfinancing instalment. To ensure a comfortable monthly installment amount Public Bank offer a long loan tenure of up to 35 years.

Loan amount up to 95 of purchase price for Green Form Applicant and 90 of purchase price for White Form Applicant. Have a valid Identity Document ie MykadPassport Have an active mobile number to receive SMS. Select on Pay Billing Account Card.

Loan Financing up to RM500000 per SME under category of Small or Medium and RM75000 per SME under category of Micro. 20 15 Housing Loan Above Rs30 lac and Upto Rs75 lac. Deposit extra cash to reduce your principal and withdraw excess money when you need extra funds Product summary Tenure Up to 35 years Interest Rate from 322 pa.

The Public Bank housing loan products offered by Public Bank include the 5 Home Plan which gives you the option to choose from a fixed Flexi and graduate loan repayment and the MORE Plan which is optimised for property refinancing. No work-life balance work after working hours and on weekends is a norm. Available in US Dollar or Khmer Riel currencies.

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Which Bank To Borrow Housing Loan Is Nice

Maybank Housing Loan Calculator Shop 53 Off Edetaria Com

Housing Loan Home Loans Loan Bank

Own A Home Together Loan Home Loans Bank

Bank Of Baroda Home Loan Bank Of Baroda Housing Loan Home Loans Bank Of Baroda Baroda

Bank Of Maharashtra Maha Super Housing Loan Home Loans Loan How To Apply

Refinance Housing Loan Refinance Loans Home Loans Cash Out Refinance

Yang 马来西亚8大银行的最新房贷利息 Public Bank Maybank Cimb Facebook

Public Bank Berhad 5 Home Plan

Home Loan Apply For Home Loan 8 80 Interest Rates Https Www Iservefinancial Com Home Loan Home Loan Eligibility Home Loans Best Home Loans Loan

Get A Seylan Siri Nivasa Housing Loan With The Lowest Rate Of 10 5 Sri Lanka Home Loans Loans For Bad Credit Loan

Public Bank Housing Loan Interest Rates Best Home Loan Interest Rate 2 90 Malaysia Housing Loan

Best Housing Loans In Malaysia 2022 Compare And Apply Online

47 Of Respondents Prefer Availing Home Loan From Public Sector Banks Survey Abhousingrealtypvtltd Realestate Realtor Home Loans Surveying Economic Times

Public Bank Berhad 5 Home Plan

Base Rate Vs Blr In Malaysia How Does Br Work Jeffery Lam 林凊迼

Mahabank Mahasuper Housing Loan Scheme Home Loans Loan Banking